Keep your spending in check with a personal budget and these 5 budgeting tips

If you gave most people a choice between climbing a rugged mountain and creating a personal budget, there would be a lot more rock climbers in the world. Something about sitting down, digging into your personal finances, and creating a monthly budget is universally unappealing.

Who

really wants to know how much money is spent on their daily lattes?

However, if you want to take control of your personal finances and save more money, you need to make a personal or household budget. It’s a relatively pain-free (and easy!) process that is less about math and more about reviewing your personal spending.

If you have budgeting anxiety, the best thing to do is take a deep breath, gather your financial statements, grab a calculator, and spend some time thinking about your financial goals. With a little bit of number crunching, your budget will practically write itself.

To make the process even easier, we’ve made a list of 5 top tips to help budgeting beginners and financial gurus take control of their personal finances.

1. Understand your spending

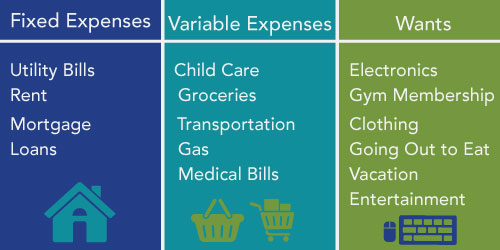

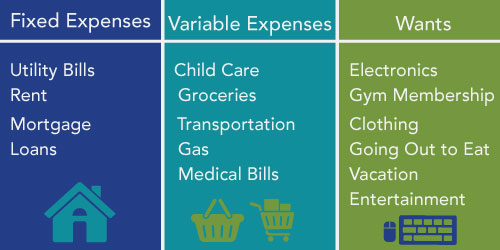

Before you start making a budget, you need to understand how you already spend your money. The easiest way to do this is to split your spending into three categories: fixed, variable, and wants.

Fixed expenses are typically your monthly bills like a mortgage payment or rent, loan repayment, insurance and utilities. Usually, fixed expenses stay the same from month to month and are essential for everyday life.

Variable expenses include things like transportation costs, groceries, medical bills, and child care. Variable expenses are purchases that need to be made every month, but that don’t always cost the same.

Wants are the nonessential purchases you make, like gym memberships, going out to eat, and electronics. As opposed to fixed expenses and variable expenses, your ‘wants’ expenses are not needed for everyday life.

Look at your expenses for the past 3-6 months to really understand how much money you spend in each category. When you understand how your money is currently being spent, it’s easier to see the areas of your budget that need some tightening or evaluation.

Using online resources, like

Delta Community Credit Union online banking and

Mint.com, is an easy way to digitally track your spending.

2. Budget to pay off your debt

Debts, such as student loans, credit card bills, and a mortgage, can take up a significant portion of your budget. Unfortunately, like doing the laundry and going to the dentist, debt payment is something you have to do.

As part of the budgeting process, review your debts and your spending. Make sure you are paying off your debts, and not spending beyond your means. Overspending is one of the easiest ways to lose control of your budget and fall into credit card debt.

Creating a budget can help you understand your debt and take steps towards eliminating it.

Generally, debt payments should be considered a fixed expense. The payments tend to be the same every month and absolutely need to be made.

If you want more disposable income to spend on new electronics and daily lattes, pay off your debt to reduce your monthly fixed expenses.

3. Be realistic with your budget

When most people evaluate their spending for the first time, the end result tends to be an overreaction. Immediately, all wants are slashed and the new budget includes a strict regimen of coupon clipping and home cooked meals.

While cutting out unnecessary spending is important, budgeting money isn’t an ‘all or nothing’ situation.

Generally, the goal of a budget is to live and save responsibly within your means. If you are a foodie and love to go out to eat, then include dining expenses in your budget. It’s not realistic for a foodie to go from eating out every night to always cooking at home.

When your goals are not practical or realistic, it’s easy to overspend, get discouraged, and lose control of your budget.

Making reasonable compromises with yourself can keep you and your budget on track. For our foodie, the compromise might be only going to restaurants on the weekends. Look at your expenses carefully and be honest about your spending habits to make the best budget possible.

4. Budget for the future

When you create your budget, you need to consider more than just daily or monthly expenses. Planning for the future is a huge part of the budgeting process. If you want to go to Europe, pay for your child’s education, or

retire at 55, you should include those goals in your budget.

In addition to fixed expenses, variable expenses, and wants, your monthly budget should include a category called savings.

Every month, you should think about your long term goals, like retirement, your short term goals, like a European vacation, and the amount of money you would need in an emergency. During the budgeting process, make an effort to set aside money to achieve those goals.

While saving for retirement may seem like a huge or unachievable goal, using your budget to set aside a little bit of money every month is an easy way to turn your financial dreams into reality.

5. Reevaluate your budget every month

Birthdays, graduations, and holidays can be expensive. These events are an easy way to overspend and lose control of your budget. Thankfully we know exactly when these special events happen and can include them in our budget.

Taking control of your money isn’t a sprint, it’s a marathon. And each mile, or each month, can be completely different than the last.

Your budget should be a work in progress. Every month, revisit your budget and reevaluate your spending. If you know that a special event or an unusual expense is coming up, you can use your budget to plan for it. If you realized you overspent on gas, but underspent on groceries, tweak your next budget to reflect this change.

Personalize your budget to completely reflect your financial goals and needs. When your life or your financial goals and needs change, it’s perfectly ok to change your budget too.

A personalized budget is a crucial part of taking control of your money and achieving your financial goals. When you start getting serious about your personal finances, making a budget is half the battle. With these tips, you can tackle your first budget or improve an existing one.

Climbing a mountain is hard. Next time you start having budget making anxiety, follow these 5 tips and leave the mountain climbing to the professionals.