Collaborate

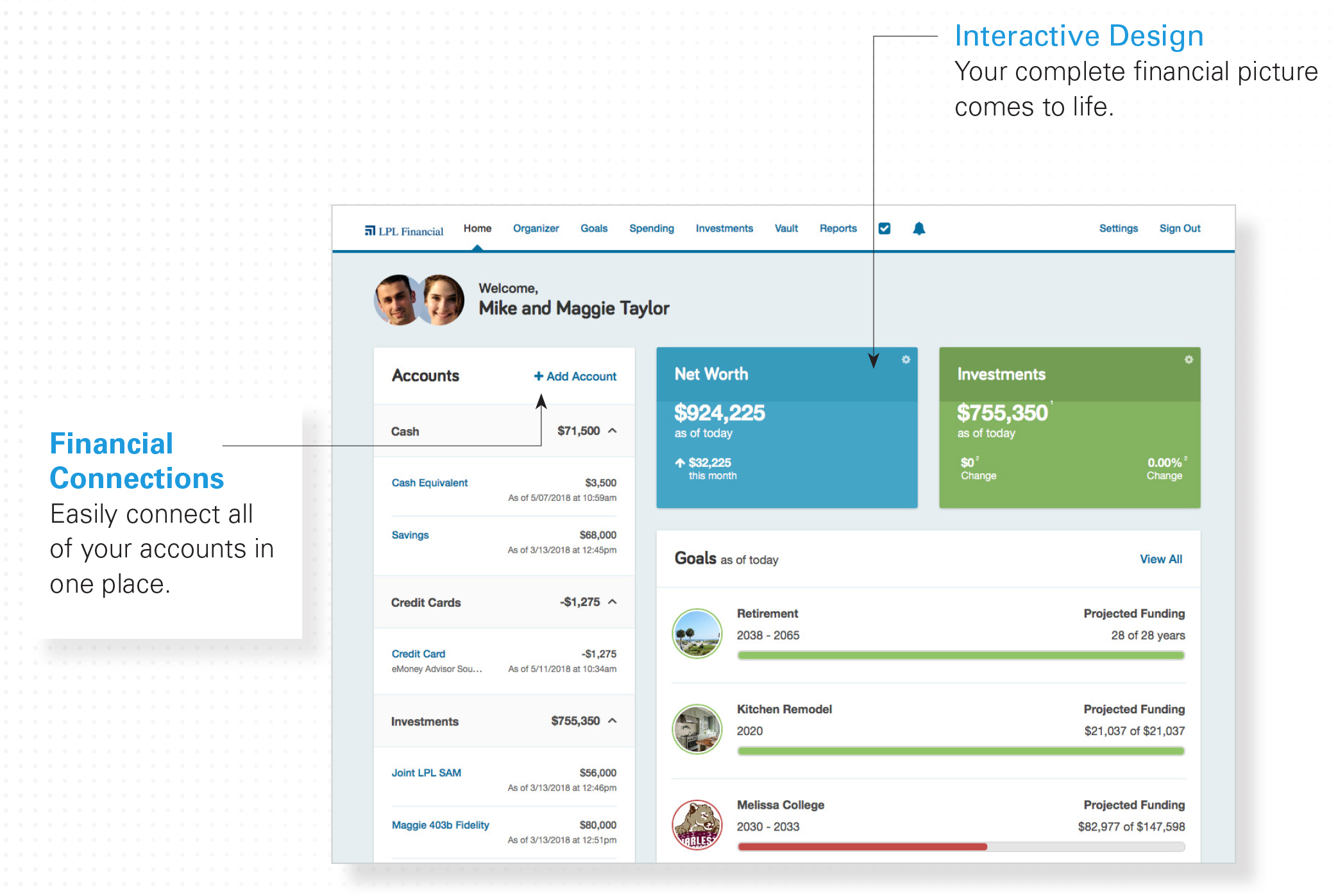

By enrolling in WealthVision, you and your CERTIFIED FINANCIAL PLANNER™ professional can collaborate, set accurate goals and track your progress. This real-time resource puts information at your fingertips to make critical decisions when you experience a life event. Your entire portfolio is updated every day so it will be ready when you are.

Digital Vault

Access all of your most critical documents on the go. WealthVision’s Digital Vault allows you to store private files and share them as needed. Some of the key documents it can store include:

- List of medication and healthcare directive

- Household inventory list or video

- Copies of passport, birth certificate, marriage license, and DD Form 214 (Certificate of Release or Discharge from Active Duty from the U.S. military)

- Financial power of attorney and will or trust

- Titles to homes, auto, boats, etc.

- Employment benefit statement

- Social Security statement

- Pension documents

- Insurance contracts

- Tax returns

- Other important legal, medical, financial and household documents

Secure

With its 256-bit encryption, you can trust that your information and any sensitive documents are safe and can only be seen by you and your designated advisor, CPA, or approved family member. And, perhaps most importantly, you never have to worry about your information being shared with online advertisers and other service providers.

WealthVision is available via desktop or mobile browsers.

If you have an investment account with us, it’s easy to create your WealthVision account and begin using it now.

LPL Financial

Delta Community Retirement & Investment Services offers investment strategy, retirement advice and a range of financial services, combined with access to financial planning resources through our relationship with LPL Financial.

Check the background of investment professionals associated with this site on FINRA’s BrokerCheck.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP® and CERTIFIED FINANCIAL PLANNER™ in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

Your Credit Union (“Financial Institution”) provides referrals to financial professionals of LPL Financial LLC (“LPL”) pursuant to an agreement that allows LPL to pay the Financial Institution for these referrals. This creates an incentive for the Financial Institution to make these referrals, resulting in a conflict of interest. The Financial Institution is not a current client of LPL for brokerage or advisory services. Please visit https://www.lpl.com/disclosures/is-lpl-relationship-disclosure.html for more detailed information.

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker/dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Delta Community Credit Union and Delta Community Retirement & Investment Services are not registered as a broker/dealer or investment advisor. Registered representatives of LPL offer products and services using Delta Community Retirement & Investment Services, and may also be employees of Delta Community Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from and not affiliates of Delta Community Credit Union or Delta Community Retirement & Investment Services. The Delta Community Retirement & Investment Services site is designed for U.S. residents only. The services offered within this site are offered exclusively through our U.S. registered representatives. LPL Financial Registered Representatives associated with this site are licensed in all 50 states.

Securities and insurance offered through LPL or its affiliates are: